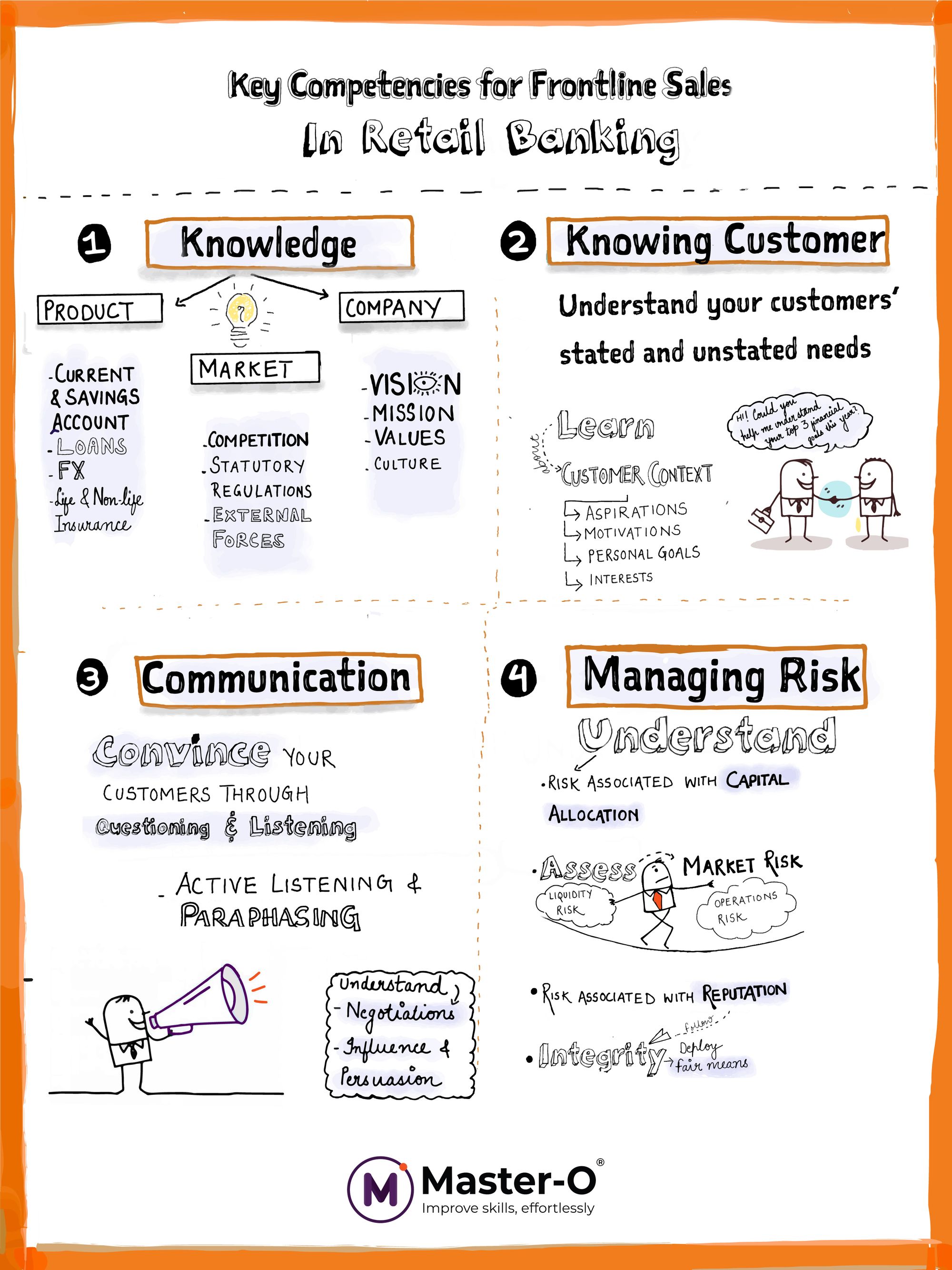

Importance of frontline sales in any organization cannot be emphasized. Sales competence is often the key differentiator between high performing and low performing sales organizations, across industries. As leaders continue to invest in various initiatives to increase the efficiency and effectiveness of their frontline sales teams, let’s take a look at some of the key competencies for high performing frontline teams in retail banking:

- Knowledge: This competency pertains to possessing a detailed understanding about the retail banking industry, competitor banks and various banking products like savings and current accounts, loans, FX and life and non-life insurance to name a few. Relationship managers, BDMs, relationship officers and other frontline staff must be able to determine

- What external forces are influencing the future of retail banking and it’s impact on banking operations

- Who are the bank’s biggest competitors and what USPs of your bank can best differentiate your solutions

- Furthermore, knowledge around pertinent statutory & regulatory guidelines will help make informed decisions and mitigate risks

- Knowing your customers: Enhancing customer’s experience is of paramount importance. Thus knowing your customers and understanding their stated and unstated needs becomes critical. It is important that frontline sales reps understand the bank’s business strategy to acquire New To Bank customers and how it plans to increase it’s wallet share in existing customers. Researching to know the personal and financial goals (both short and long term) of customers can best position your frontline sales reps to gain the customer’s trust and offer the most suitable solutions across situations.

- Communication: The foundation of sales success is the ability to gather and articulate information in a way that makes your prospects want to do business with you. Your value proposition, your pricing, even your product’s features will be rendered futile if you’re not able to communicate well. Frontline sales teams need to develop an ability to convince customers by asking pertinent questions around their requirements. At the same time, they should practice ‘active listening’- it is observed that very often, salespeople are waiting for their turn to talk or thinking about what to say next, instead of truly listening to the customer. They should listen intently and then paraphrase to seek clarity and confirmation.

- Managing Risk: RMs, CSMs and other frontline staff often need to have an acute sense of managing risk since they have a first-hand view of various issues that might escalate. They also need to effectively communicate risk information within the bank. By developing risk management acumen, front line sales will be better positioned to sell and serve their customers while ensuring no credit or operational risk for the bank. They also need to understand the risks associated with market and capital allocation and how any unlawful practices such as anti-money laundering can tarnish bank’s reputation.